E-mail Cheque Scams in the Makeup Industry: How to Spot and Avoid Fraudulent Transactions

The makeup industry is booming—globally, consumers are spending billions on beauty products each year, and there has been a huge emphasis on makeup artistry for every consumer. Makeup artists are more popular than ever. However, with the growth of the industry comes the rise of fraud, and one of the most common scams hitting the beauty world is cheque fraud.

Cheque scams are not a new phenomenon, but their presence in the makeup industry continues targeting beauty professionals especially makeup artists that are new in the industry and hungry for work. These scams cause financial harm to those who fall victim. In this blog post, we'll dive into this prevalent cheque scams that has been in the beauty industry since the beginning of my career in 2013 and, most importantly, how to protect yourself.

Cheque scams typically operate under the guise of a legitimate transaction, but they are designed to trick the recipient into providing products or services before the payment actually clears. Here's how it usually works:

The Fake Order or Booking: A scammer might contact you, pretending to be a customer or even a company representative. They will make an inquiry for a large booking for an upcoming booking date.— This booking will look very attractive as it falls on a typically quiet weekday or a Sunday that you will likely not already have a large wedding party on.

Too Good to be True: The client will have no issues with your quote and would like to book you right away and pay the deposit by cheque. When asking for other forms of payment they will insist it must be cheque as it will be their husband that will pay the deposit, a boss, or another family member as a gift. They will also offer to pay a deposit that is higher than what you asked for.

The Wait Game: You’ll receive an actually physical cheque. They’ll say something like “oh this was a mistake. I am so sorry,” and ask you to refund the overpayment and send excess money back to them. Initially, everything seems fine—the cheque clears into your account. But after a week or two, the bank contacts you, letting you know the cheque was counterfeit or issued from an invalid account.

The Fallout: By the time you realize the payment isn’t legitimate, you've already sent out the refund, leaving you out of pocket and with no way to recover the lost funds.

How to Protect Yourself

2. Verify the Client or Customer

If you’re dealing with a large booking or someone you don’t know, do some background research:

Check contact information and look up the person or company online. A quick Google search can reveal if they’re legitimate.

Ask for references from other professionals in the industry who may have worked with them before.

Contact the bank: If you’re unsure about the legitimacy of a cheque, it’s always wise to contact the issuing bank directly.

3. Use Secure Payment Methods

While cheques are common, they’re not the safest payment method in today’s world of digital transactions. Consider using secure payment platforms like PayPal, Stripe, e-transfers, Square which offer more security and faster processing times. They are also free to use for customers and easy to set up as a vendor with $0 monthly fees and only a 2.9% transaction fee for credit cards.

1. If you must accept a cheque- Wait for the Cheque to Clear

Even if a cheque appears to have cleared and is showing in your account, always wait until the cheque is fully processed by your bank, which can sometimes take several days. This can help avoid falling victim to a bounced cheque scam.

Suspicious Cheques: Look out for cheques with unclear or missing information, such as:

Spelling mistakes on the cheque or in the name of the issuer.

Unusual fonts or paper quality that looks off or inconsistent.

Lack of proper bank details (like missing logos or addresses).

4. Educate Your Team

If you run a beauty business with employees or collaborators, ensure everyone is aware of potential scams. Regular training and information about common fraud tactics can help you avoid costly mistakes.

5. Have a Clear Refund Policy

Ensure your refund policy is clearly stated in your contract or terms of service. Avoid issuing refunds before the payment has been fully processed and cleared.

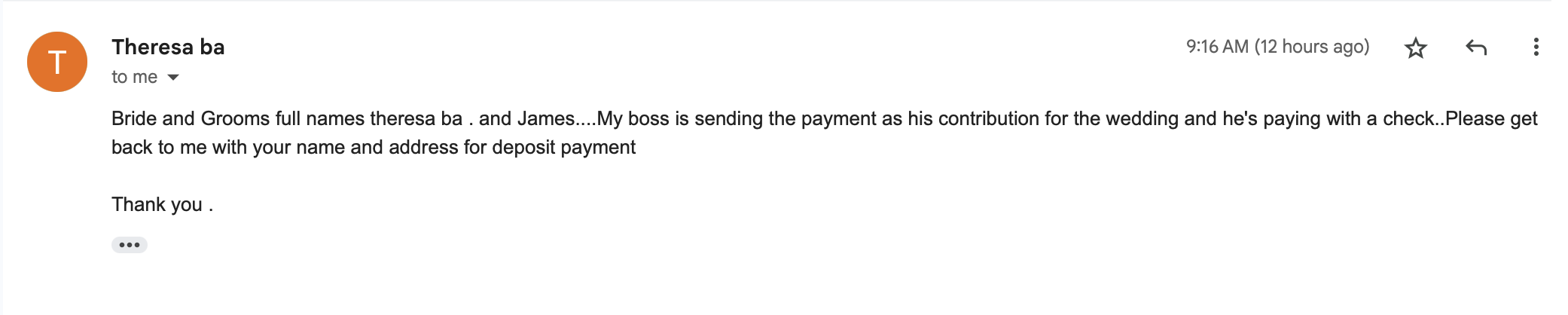

We’ve included a recent scam email from March 2025 from the email theresaba4@gmail.com for some reference.

An email inquiry from a scammer posing as a real client.

The quote attached explains the deposit is payable by e-transfer which is for an amount of $278.25.

The scammer has no issues with the quote provided and are ready to pay immediately. They offer to pay more than double the required deposit amount by cheque.

After explaining we have a strict policy of no cheques due to prevalent cheque scams, and we can accept PayPal, Square, or E-transfer this was their reply.

To a new artist, this can seem harmless and may look like a legitimate excuse from a potential client. If you do not know the person, do not send them a personal address and do not take a cheque. I have already offered this client easier methods of payment so her excuse to pay by cheque is illegitimate.

By staying vigilant, verifying all transactions, and using secure payment methods, you can protect yourself from falling victim to these fraudsters.

The best defense is knowledge, so always be on the lookout for red flags and trust your instincts. Stay informed, and don’t let cheque scammers get the better of you!